We'll Help You Buy Your Dream Home

Start the Buying Process.png)

Buying a home is quite the step. Whether

it's your first home or your 11th, it's all a big investment.

We have quite the squad of knowledgeable peeps to help guide you.

When you are going to start searching for a home, figure out your budget, and then make a

wish list. Step one is to talk to a lender to figure out your spending power.

What you can

afford may be different than you thought. The next step is to make a top 5 of must have's and then

as you start to look, think about the 80-10-10 rule. 80% you love about the house, 10% you can

change, and 10% you can live with. That'll really help to pinpoint the right home for

you.

Search around on any device on our site and be sure to check out school ratings,

neighborhood info, and walk scores.

Neighborhood FAQs

Have a question not listed here? Email us at info@kanofskygroup.com

{{FillInLater}}

TEST TEST

{{FillInLater}}

{{FillInLater}}

{{FillInLater}}

{{FillInLater}}

{{FillInLater}}

{{FillInLater}}

{{FillInLater}}

{{FillInLater}}

Know Your Mortgage Payment

Based on the home's sale price, the term of the loan, buyer's down payment percentage, and the loan's interest rate, this calculator can help estimate what you'll need to pay out monthly for your new home. This calculator factors in PMI (Private Mortgage Insurance) for loans with less than a 20% down payment, as well as town property taxes and its effect on the total monthly mortgage payment.

Buying a home is a big step! Whether you're buying your first home, your dream home, or your tenth investment property, yours will be a big investment. We know how important this is to you and we have an army of experts to make sure we find the perfect property for your unique circumstances. Finding the perfect property is just one way we can help you with your real estate purchase.

In order to determine the amount of home you can afford a lender will use your debt-to-income ratio to determine the percentage of your pre-tax income you spend on debt. Your debt ratio will include: monthly housing costs, car payments, credit cards, student loans, and any other installment debt. If you take on more debt before buying a home it will have an impact on the amount of the loan that the lender will finance.

Learn MoreStart Your Search

When buying a home, start by making a wish list and setting a budget. We can help you choose a lender to get you pre-approved for a loan, and then you're ready to start house hunting. Search for your dream home from any device on our website. You can even compare walk scores, school ratings, and neighborhood demographics for different listings.

GET FREE INSTANT ACCESS

TO LOCAL HOMES FROM ANY MOBILE DEVICE

Keller Williams Realty Real Estate Search available on Android, iPhone, or iPad gives you access to more than 4 million homes.

Download Our App

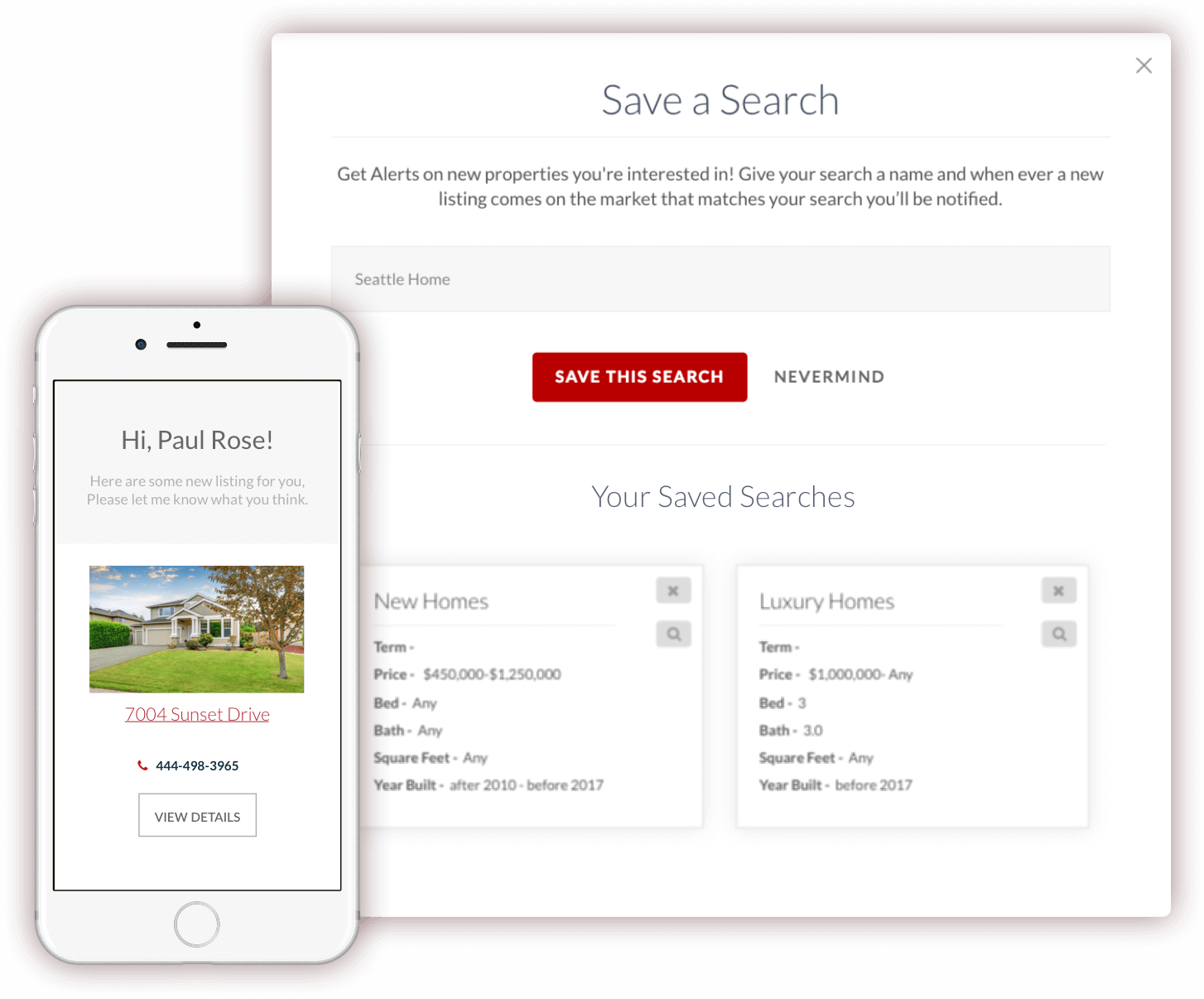

Get Listing Alerts

When you save a search on our site, any new homes matching your wish list criteria will be delivered straight to your inbox the moment they go up for sale.

Save And See Listings

Click the icon when you find a house you love to save it in your favorites section and let us know you like it. Hit "See This Listing" or reach out to your agent directly to schedule an in-person showing. We're happy to walk you through the home and answer any questions, so you can make an informed decision.

Making An Offer And Closing

When you find a home you love, we will guide you through the offer process. We are experienced negotiators and will do everything in our power to get you into the house that you want. Our work doesn